If you live in or have visited a big city, you’ve probably run into street vendors—people who sell everything from hot dogs to umbrellas in carts—on the streets and sidewalks. Many of these entrepreneurs sell completely unrelated products, such as coffee and ice cream.

If you live in or have visited a big city, you’ve probably run into street vendors—people who sell everything from hot dogs to umbrellas in carts—on the streets and sidewalks. Many of these entrepreneurs sell completely unrelated products, such as coffee and ice cream.

At first glance, this approach seems a bit odd, but it turns out to be quite clever. When the weather is cold, it’s easier to sell hot cups of coffee. When the weather is hot, it’s easier to sell ice cream. By selling both, vendors reduce the risk of losing money on any given day.

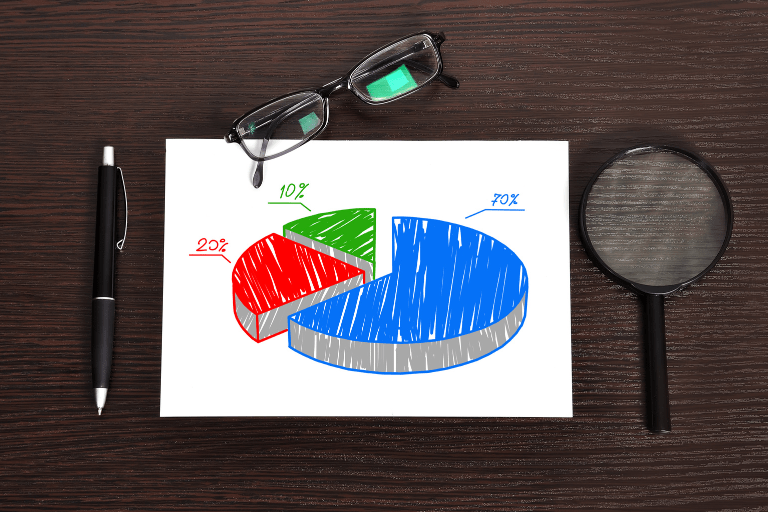

Asset allocation applies this same concept to managing investment risk. Under this approach, investors divide their money among different asset classes, such as stocks, bonds, and cash alternatives, like money market accounts. These asset classes have different risk profiles and potential returns; therefore, offsetting any losses in one class with gains in another, and thus reduce the overall risk of the portfolio.

When considering asset allocation, It is also important to consider taxation on your investment accounts and whether or not you have access to your capital.

Asset allocation is a critical building block when creating a portfolio. Having a strong knowledge of the concept may help as you consider which investments may be appropriate for your clients and prospects’ long-term strategy.

If you currently have your clients’ assets positioned quite differently than what they really want concerning risk, taxation and access to money, when would you want to know? The Circle of Wealth®’s Allocation Mix presentation can help you communicate this concept to your clients and also make sure they have their investments allocated appropriately.

Click here to see how one of MoneyTrax’s Master Mentors, Crystal Langdon uses the Circle of Wealth’s Allocation Mix presentation tool to discuss this concept with her clients and prospects.