One of the most common questions in retirement planning is: Should I contribute to a traditional (pre-tax) IRA or a Roth (tax-free) IRA?

The answer? It depends.

That might not be the flashy response people want, but it’s the honest one—and it’s a great starting point for a deeper conversation about taxes, time, and future income.

💡 The Premise: What If Everything Was Equal?

To help clients understand the difference between pre-tax and tax-free strategies, we often walk through a simple comparison. Here’s the premise:

Let’s say someone earns $10,000 in income and wants to invest it.

-

With a traditional IRA, they contribute the full $10,000 pre-tax.

-

With a Roth IRA, they first pay $2,400 in taxes (assuming a 24% tax rate), and then contribute the remaining $7,600 after-tax.

We’ll assume:

-

An 8% rate of return until age 65,

-

Then a 5% rate of return in retirement,

-

Distributions begin at 65 and continue to age 90,

-

The tax rate remains constant at 24% throughout.

📈 What Happens Over Time?

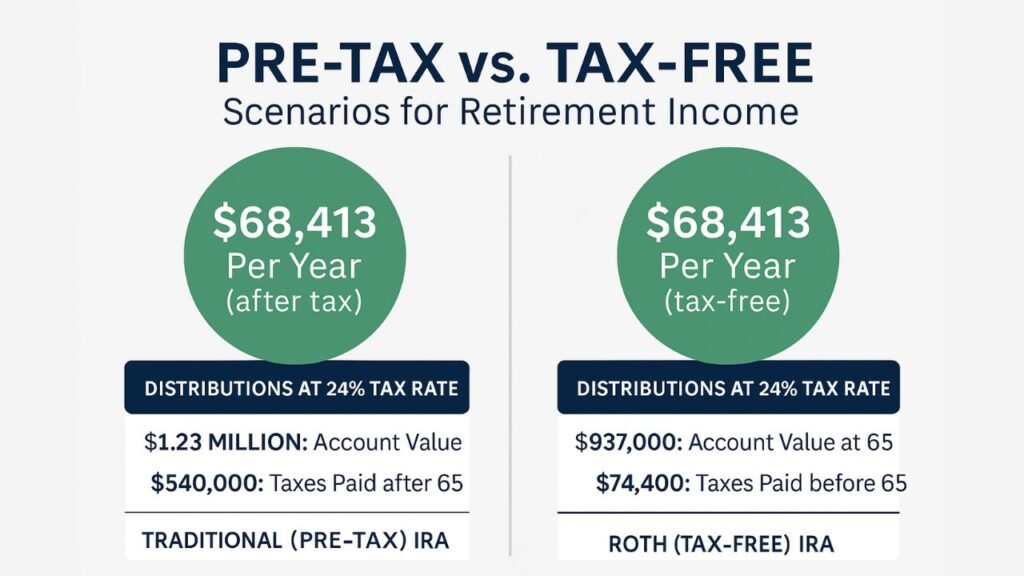

Traditional (Pre-Tax) IRA

-

Grows to $1.23 million by retirement

-

Distributes $90,000 annually, but after taxes, spendable income is $68,413

-

Total taxes paid over retirement: $540,000

Roth (Tax-Free) IRA

-

Grows to $937,000 by retirement

-

Distributes $68,413 annually, and it’s all tax-free

-

Total taxes paid (only during working years): $74,400

Wait a second—both strategies provide the exact same spendable income in retirement: $68,413 per year.

That’s the key point: in a static environment, where tax rates and returns don’t change, pre-tax and Roth accounts can produce the same lifestyle income.

🚨 But Here’s the Catch: We Don’t Live in a Static Environment

Real life isn’t that tidy. Tax laws change. Market returns fluctuate. Clients change jobs, move, retire early, or live longer than expected.

Let’s take a closer look:

-

With a Roth, taxes are paid upfront—$74,400 spread over 30 years.

-

With a traditional IRA, taxes are deferred. But in just four years of retirement, the total tax bill already exceeds what was paid over 30 years in the Roth scenario.

And that’s assuming tax rates stay the same.

But let’s be honest: Most people—and most financial professionals—believe taxes are going up in the future.

🤔 So Why Does the Government Prefer Pre-Tax Contributions?

Because deferring taxes means larger revenue later. In our example, the government collects $540,000 in taxes over time from the traditional IRA, compared to only $74,400 from the Roth.

That’s a huge difference—and it’s why showing clients the long-term impact of their tax strategy is essential.

🛠 Tools to Make the Conversation Visual

There are powerful tools within the Circle of Wealth® system to help illustrate these scenarios clearly for clients:

-

Compare spendable income, growth, and taxes side-by-side

-

Show how long it takes to reach the same tax liability in each scenario

-

Adjust future tax rate assumptions to show how quickly the Roth becomes more favorable

✅ The Takeaway

The question isn’t just “Which is better: pre-tax or Roth?” The better question is:

What assumptions are we making about taxes, income, and risk—and are those assumptions realistic for the future?

In a static world, the math might say they’re the same. But we don’t live in a static world. And that’s where the Roth can provide powerful peace of mind—especially in a rising tax environment.

Watch Matt Rzepka, CPA walk you through this Quick Concept:

Ready to Grow Your Practice with the Circle of Wealth®?

🎥 Watch our “Learn More” videos – See how the system works in real client scenarios. 👉 Watch Videos Now

🧠 Join a Discovery Webinar – Hosted monthly to walk you through how top advisors are using Circle of Wealth®. 👉 Register for the Next Webinar

📅 Schedule a Private Demo – Get your specific questions answered and see how the system fits your business. 👉 Pick Your Date & Time

🚀 Try the Software + Coaching – Experience it firsthand with a complimentary trial. 👉 Start Your Free Trial