Inside the Circle of Wealth® system is an invaluable tool for demonstrating a prospect’s current financial situation and planning for retirement – the Personal Economic Model®. The PEM, for short, is a powerful way to showcase the value you bring through your expert insight and guidance.

Learning from the Medical Profession

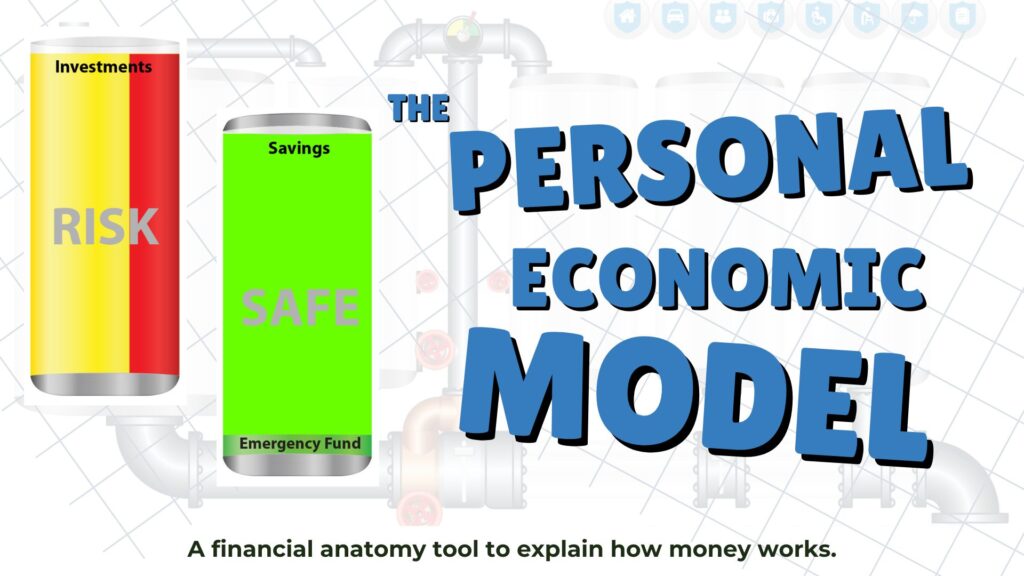

The adage “a picture is worth a thousand words” rings true in many professions, including finance. The PEM acts as a comprehensive visual representation of a family’s entire financial landscape.

To understand why such a visual is so effective, consider how the medical profession communicates complex information to patients. Doctors, who spend years mastering human anatomy and medical procedures, often face a communication gap with patients who lack medical knowledge. To bridge this gap, doctors use models and diagrams to explain diagnoses and treatments clearly.

Similarly, financial professionals, who spend years learning about finance and using complex terms, can also struggle to communicate effectively with clients. Without a clear visual aid, clients often leave meetings confused and may not follow through with sound advice.

By adopting a visual model, like the one used by doctors, we can bridge this communication gap. The PEM in the Circle of Wealth® is designed to do just that.

Introducing the Personal Economic Model® (PEM) to Prospects

When working with a family’s financial situation, starting with a visual representation of their financial anatomy can be incredibly helpful. Here’s how you can use this model to explain their financial picture:

- Understanding the Model

- Flow and Storage of Money: The model visually depicts how money flows into and out of the family’s finances. The “Lifetime Capital Potential” tank illustrates the total money they will earn over their lifetime, though it might seem incremental as it flows in gradually.

- Tax Filter: The first valve in the model represents taxes. This valve is controlled by the government and reduces the amount of after-tax income available.

- Lifestyle Regulator: This valve is within the family’s control, dictating how much money is allocated to their current lifestyle versus savings for the future.

- Exploring the Savings Tanks

- Risk Tank: This tank holds money that has the potential for higher returns but also comes with a risk of loss. Investments like mutual funds, real estate, and variable annuities typically fall into this category.

- Safe Tank: In contrast, this tank represents money that is secure from loss and provides easy access. It includes assets like cash, CDs, fixed annuities, and savings accounts.

- Assessing Major Lifestyle Purchases

- Review the major expenses, such as college tuition and weddings, to ensure there is enough liquidity to cover these significant life events.

- Protection Needs

- Evaluate protection strategies for unforeseen events, such as disabilities or premature death, and ensure that property and liability needs are adequately addressed.

Achieving Position A

Position A represents a financial state where:

- Sufficient funds are accumulated in the savings and investment tanks to maintain or improve the standard of living during retirement.

- There is ample access to money for significant life purchases and financial protection against unexpected events.

By using the PEM, you can help prospects visualize their financial situation and understand the impact of their decisions. This clarity enhances their ability to follow your advice and make informed financial choices.

Discover how the Circle of Wealth® can help you expand your client base and close more sales:

- Watch the “Learn More” videos (watch videos now)

- Attend a Discovery Webinar hosted monthly (register for the next webinar)

- Schedule a private demo to get your specific questions answered (pick your date and time)

- Take our software for a spin and experience our coaching with a complimentary trial (start trial)